Batteries have become increasingly popular over the years, and today are routine in the modern home. From a standard AAA battery in a television remote control to a sophisticated lithium-ion battery in a car, batteries fit a wide range of products, sizes, chemistries, and markets. As shown in the graph below, batteries have seen consistent growth for the past three decades.

Of the over $36 billion of revenue in total battery trade in 2016, lithium-ion batteries were responsible for a little over $15 billion.

To have lithium-ion batteries account for roughly 42% of all battery trade makes sense. After all, lithium batteries have become the de facto battery of choice for smart electronics and electric vehicles. The importance of this market will only grow in the foreseeable future as the world becomes more electrified and governments push for clean energy policies and regulations.

For solar systems, energy storage with lithium-ion batteries provide greater grid resilience, offset time-of-use rates, and enable individuals to live off-grid in a higher energy density battery. Lithium-ion batteries, compared to their lead-acid or gel cousins, allow for more cycles, a higher depth of discharge, have lower self-discharge rates and require zero maintenance. According to Bloomberg New Energy Finance, the United States will be the leader in 2030 in terms of global energy storage deployments.

Lithium-ion batteries will play a major role in this growth, but it could be expanded further if the cost of these batteries continues to decrease. Some solar installers want to grow their lithium-ion battery sales quickly; however, the price for homeowners is still significant. As such, there remains a substantial retrofit market opportunity for existing PV systems as costs continue to fall and homeowners look to install energy storage systems later on.

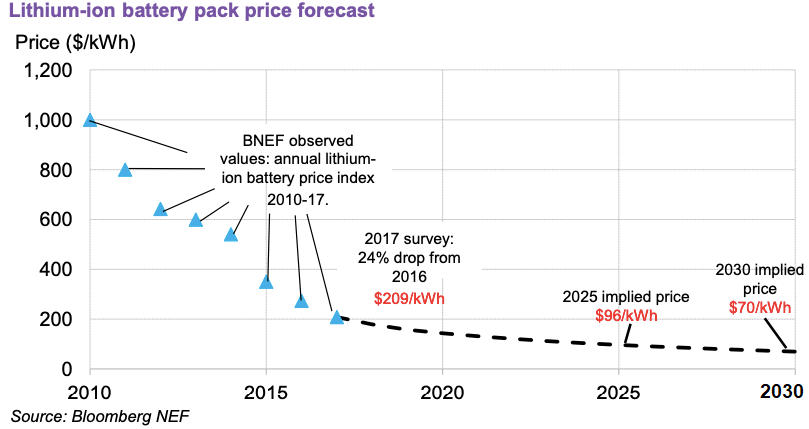

The graph below is a prediction from Bloomberg New Energy Finance on the price of lithium-ion battery packs in years to come.

If the implied prices in this graph turn out to be correct, we should see lithium-ion batteries selling for half of their market prices today within a few years (if, of course, manufacturers pass on these cost reductions to consumers). Yet, there are two key supply chain challenges which could stall cost reductions of lithium-ion batteries in the United States.

First, South Korea has become the main supplier to the United States for lithium-ion batteries, recently surpassing China. Popular consumer electronics brands like LG Chem and Samsung have successfully conquered the American market from Chinese brands. However, South Korean demand has ramped up dramatically in the last year, constraining the available supply in the United States and keeping prices of lithium-ion batteries at the same level or higher through distribution markets (we witnessed this in the energy storage space with the LG Chem battery shortage this year).

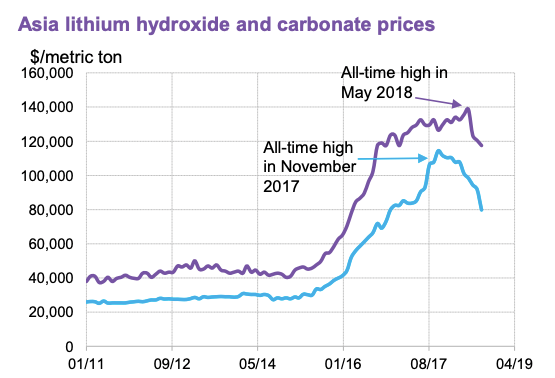

Second, not only is China the world's largest lithium-ion battery manufacturer, but the country also enjoys one of the three largest lithium reserves in the world. As China continues to vie for manufacturing control, it is likely that the effects of lithium commodity trading will be felt in the United States. And, as the graph below illustrates, these prices have gone up recently and can do so again in the future.

As long as mines are built quickly enough, research shows that there will be enough lithium supply to meet forecasted demand for electric vehicles, energy storage systems, and other applications. American battery manufacturing companies could explore different lithium-ion battery chemistries (there are six main chemistries in use) to rely less on volatile foreign minerals, source their materials locally, and bring costs down. Cobalt, one of the key materials used in several lithium-ion battery chemistries, is already being phased out by some battery chemistries such as lithium-ion manganese oxide and lithium iron phosphate. In addition, manufacturers like Tesla and Panasonic have vowed to reduce, if not completely eliminate, the use of cobalt in their batteries. This is due to the fact that the Democratic Republic of Congo, responsible for 60% of the world's cobalt supply, has recently come under international pressure for human rights abuses and poor health and environmental conditions that occur in its cobalt mines. On the policy side, if federal and state governments provide attractive incentives for energy storage, such as California's Self-Generation Incentive Program or allowing battery net metering, Americans may fret less about the upfront costs of lithium-ion energy storage solutions.

The rise of electric vehicles in the next decades is the key element driving down the prices of lithium-ion batteries. Based on current demand and pricing projections, it seems as if lithium-ion energy storage systems will become the norm in the future. However, should EV batteries have the same materials and components as those made for residential and commercial energy storage systems? The popularity of the former can lead to decreasing costs for the latter, but can also lead to situations like the LG Chem shortage happening more often as manufacturers prioritize the electric vehicle market over the energy storage space.

To learn more about some of the lithium-ion battery options in the market, or energy storage systems in general, contact your dedicated Account Manager and visit Greentech Renewables' Energy Storage page.