Although it depends on volume and module type (Poly, Mono, Optimized, etc.), module pricing is 25% less today than it was at the start of the year. This has allowed many independent solar contractors to enjoy lower module prices and helps move Distributed Generation (DG) solar closer to grid parity ahead of schedule. Even though other factors exist such as improved soft costs and inverter technology, the significant module price drop has been a pleasant surprise for solar contractors and it appears prices will stay low.

Understanding the Price Drops

Economics’ basic principle of supply and demand has caused the significant price reduction. Although the total megawatts deployed in the U.S has increased in 2016, most if not all, of these installation forecasts have been revised down; SEIA initially expected 16 GW deployed in 2016, but now that figure is between 10 and 13 GW. The extension of the Federal ITC pushed out several utility projects and this is the main reason demand has declined. In the Distributed Generation segment, leading installer SolarCity (about 30% market share) reduced their installation forecast from 1.2 GW to .9 GW. However, SolarCity’ installation reduction is due to their objective to decrease costs and focus on profitability instead of aggressively growing sales. Since major module manufacturers increased capacity to meet expected demand, the tier-1 manufacturers have slashed prices due to excess supply.

What This Means for Independent Solar Contractors

Over the next 12 months, grid parity is possible across the U.S. Module prices should remain low and, because of ITC and financing vehicles, independent contractors should be able to offer profitable systems that are close or lower than current electricity tariffs.

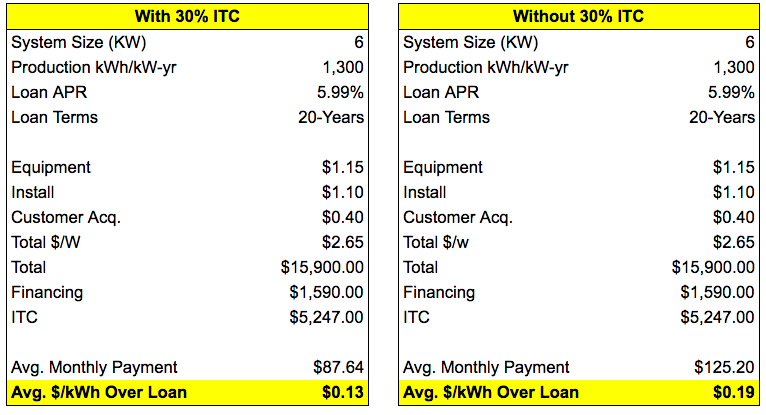

It depends on the equipment, but $2.50-$2.75/ is not inconceivable install cost for a residential project: $1.15/w for tier-1 equipment, $1.1/w for labor, and $.40/w for customer acquisition. Most solar contractors have access to 5.99% 20-year loans (with 10% dealer fee) and if the homeowner monetizes the 30% ITC they can pay less for electricity by going solar--assuming 6 kW system. The example below assumes 6 kW and 1300 kWh/KW-year, which covers half of the country.

One More Important Thing to Be Aware Of

It remains to be seen what will happen to the PV module market. While module manufacturers will reduce production, module prices should remain low unless their capacity is once again constrained. Barring a new FIT, significant policy change, or revolution in PV technology, it is unlikely global PV demand will continue at this blistering pace. This means that tier-1 manufacturers may be in for another bumpy ride and have trouble maintaining profitability. Solar contractors should expect lower installation costs but they should pay closer attention to manufacturer’s stability and understand their warranties in the event of liquidation or bankruptcy. Although uncertainty will exist for some of the industry’s largest companies, independent solar contractors are in excellent position to offer simple, cost-saving solar solutions.