There has been a lot of recent action in the solar financing universe around eligibility rules. This article will explore different strategies that solar lenders are using to balance the market’s competing desires for better pricing and approval rates.

When discussing product eligibility, many lenders will use the term buy box to describe the range of approval criteria for loans. The most impactful factor is typically the minimum FICO score, but the buy box is also shaped by other limits such as:

- Maximum DTI (debt-to-income ratio)

- Maximum loan amount

- $/W caps and restrictions on non-solar

- adders

- Property type requirements

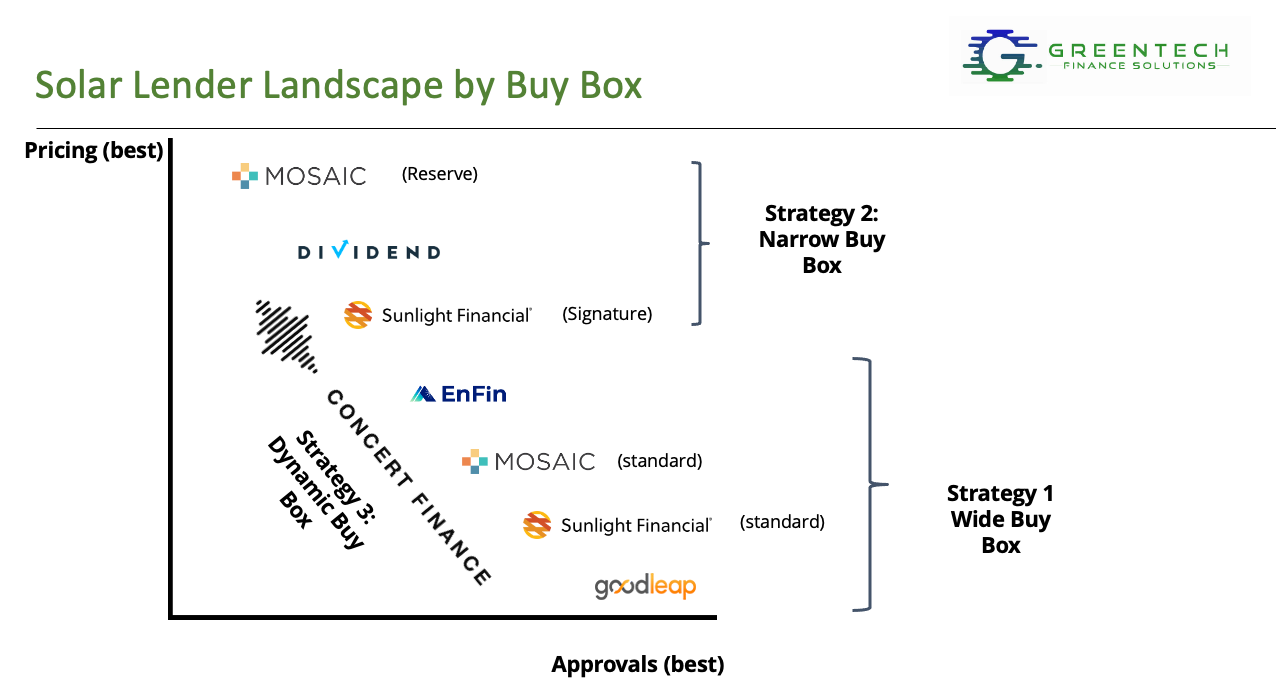

All else equal, installers prefer for a lender to have a wide buy box to close as many deals as possible, but here’s the rub: there is an inverse relationship between the buy box and pricing. The more deals a lender approves, the worse their loan pricing needs to be to account for higher expected default rates. As the market has evolved, lenders have introduced new product structures that allow installers to better match their buy box to their desired pricing/approvals balance. The way I see it, there are now three main buy box strategies in residential solar lending:

(“Graph” is not to scale or comprehensive).

Strategy 1: Wide Buy Box for Maximum Approvals

During the boom times of solar financing (2020-2022), borrowing costs were so low across the economy that homeowners in almost all markets could achieve year 1 savings with a hyper-low interest solar loan. As a result, lenders competed on approval rates, widening the buy box as much as possible. Most major FinTechs at that time offered a standardized price for all consumers down to the mid-600s in FICO, and several of them also came out with sub-prime products with higher pricing. We’ll call this wide buy box approach “strategy 1.”

As interest rates skyrocketed in 2022-23, however, it became more difficult for solar loans to deliver year 1 savings, especially in markets with cheap power. Lenders who were slower to raise pricing attracted volume. Dividend consumed market share during this period, partly enabled by already having a slightly higher FICO floor than its competitors (a pioneer of “strategy 2” mentioned below). On the flip side, Goodleap raised its pricing the most of any major solar fintech and maintained a wide buy box. EnFin also entered the scene in 2023 with a wide buy box and has maintained that position since.

Strategy 2: Narrow Buy Box for Best Pricing

With installers and consumers desperately craving lower rates, lenders began to look for creative strategies to offer better pricing despite persistently high interest rates. In the fall of 2023, Mosaic rolled out its Reserve program, which offered significantly lower rates (3-5% lower dealer fees on average) offset by a higher FICO threshold. This offering has been a great fit for the current market in which most installers are prioritizing pricing over approval rates and has driven an uptick in volume for Mosaic in recent months. (Installers who sell Mosaic Reserve loans on the Greentech Ensemble program receive even more significant discounts!)

Sunlight recently rolled out a similar offering with a tighter buy box. The new Sunlight Signature option, available to select dealers, offers dealer fees 325 bps lower than its standard pricing, balanced by an estimated 20% lower approval rate. Additionally, Sunlight offers a generous 75 bps discount for using the Ensemble program. So, installers who qualify for both Signature pricing and Ensemble will see dealer fees about 4% lower than Sunlight’s baseline.

Additionally, the Signature pricing also includes two new price points:

- 20y 2.99%

- 15y 1.99%

Both of these price points come with steep dealer fees and still yield higher monthly payments than a 25y 3.99%, but they are unique in the market and I am interested to see how they play. Sunlight has had previous success by offering lower APR loans than its competitors with slightly shorter terms, so it’s possible that these price points could work well in today’s market.

Note: both Mosaic and Sunlight still also offer “standard” pricing with a wider buy box and worse pricing (strategy 1). Installers can choose which pricing scheme they prefer.

Strategy 3: Dynamic Buy Box with Risk-Based Pricing

In addition to the two strategies listed above for balancing pricing vs approvals, the third option is Risk-Based Pricing. In this model, the interest rate a consumer receives is correlated to the level of risk (default) they present. As with the narrow box strategy, this model rewards borrowers with great credit and preferred pricing, similar to the wide box strategy, it also allows lower-FICO borrowers to qualify with higher pricing. This strategy has been used for years by credit unions, but typically with a FICO floor in the range of 700.

Concert Finance has recently rolled out a risk-based loan product with a 25-year term, 0% dealer fee, and APRs ranging from 8.99% to 10.99% depending on the borrower’s credit. The minimum FICO score is 660. Concert’s risk-based product combines the excellent pricing that Credit Unions deliver to well-qualified borrowers with the ease of use that FinTechs deliver using Strategies 1 and 2.

Which Buy Box Strategy is Best?

As always, the right strategy varies depending on each installer’s individual needs. Two general recommendations:

- Optimize your customer profile. If your clientele has better credit, a narrow or dynamic buy box strategy will be advantageous to deliver better pricing. If approvals matter most, a lender that offers a wider buy box will be more successful.

- Diversify your offerings. As lenders integrate new buy box strategies, it creates additional options to diversify. One approach is to double down on your strategy of choice; alternatively, you could mix and match lenders with different buy boxes to better tailor loan offerings to individual consumer needs.

If you’d like to discuss picking the right buy box for your business and learn how to access discounted pricing with Greentech Renewables' lender partners, contact your local GFS representative!