The emergence of the PPA and access to financing has been a game changer for the solar industry. Of course the improving technology, declining equipment costs, streamlining permit and net-metering process, etc. is significant, but compared to 10 years ago it is much easier in more states to obtain financing for solar residential and commercial projects. One financing product is PACE (Property Assessment Clean Energy) but it hasn’t had nearly the same success as a PPA, lease, or loan. However, PACE has advantages over solar financing products and it is not as dependent on the 30% ITC.

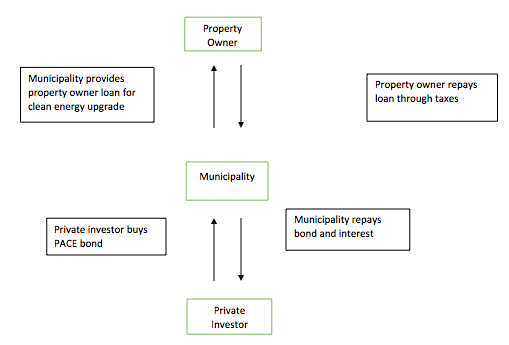

In PACE Financing the property owner receives a loan from their local municipality and the loan is repaid through their taxes, at a fixed rate, for the next 15 to 20 years; the local municipality will sell a bond to investors to offer the loan for the property upgrade. PACE’s main objective is to address the high up-front costs of clean energy projects—solar, energy efficiency, retrofits, etc.—while having fixed payments for paying the project. About 50% Americans move to new homes every 10 years, and it complicating selling their home (or if it’s a business selling a property) if they have a solar PPA or lease, but because a PACE loan is tied to the property and not the owner, changing property ownership is a non-issue; the new owner will pay the same taxes and enjoy the benefits (lower electricity prices) from the project.

The city of Berkeley, CA introduced the first PACE program in 2008 and it is now a national initiative active in 31 states. So far it has financed roughly 25,000 residential projects and 300 commercial projects totaling more than $600 Million (about 75% are energy efficiency). This combination of the 2010 housing crisis and a lengthy convoluted process has hampered PACE’s proliferation. Fanny Mae and Freddie Mack have stopped underwriting mortgages that have PACE loans and third-party financing has soared thanks to SolarCity, Vivint, Sungevity, SunRun, and Sunova. However, PACE is making a revival in the residential sector in California with the Hero Loan and legislation.

Even though the approval process may be longer that a PPA or lease, commercial projects should seriously consider a PACE loan if possible. Like PPA/lease, PACE loans will finance 100% of project’s costs (hard and soft cost), do not add additional debt, are cash flow positive in year-1, and have a quick payback (5-6 years). PACE’s main advantage is that the property owner owns the system and can take advantage of rebates, tax incentives, and depreciation laws. The payments are also fixed, so there are no price escalators, and PACE will cover energy efficiency upgrades in addition to solar. As mentioned before, the loan is tied to the property so the bond is transferrable if the building is sold. Another big challenge developing commercial solar projects is businesses tend to lease their buildings/property, not own them, so long-term financing is complicated.

PACE loans are not ideal for every commercial project, but Greentech Renewables has strong relationships with PACE brokers and can quickly determine if a PACE loan will pencil out at no cost. We encourage you to reach out to your account manager and visit PACE Now if you believe PACE could help finance your solar projects.