Geli, in partnership with Woodlawn Associates, completed a study examining the economics of solar and storage. Specifically, they calculated the value of solar and storage for two commercial buildings in each of three markets: California, New York, and Hawaii. They found that solar and storage were strongly synergistic in all three markets. The NPVs of solar + storage investments were greater than the sum of the NPVs of solar investments and storage investments alone because, among other reasons:

-

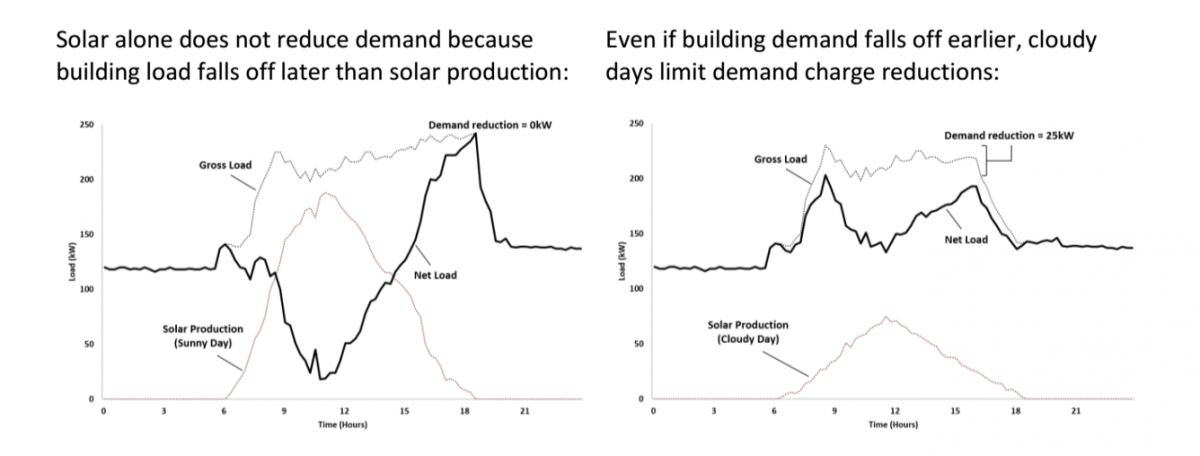

The combination allows for much larger demand charge reductions than either technology can achieve on its own

-

Pairing storage with solar allows the owner of the storage system to claim the federal Investment Tax Credit on the storage system, subject to certain constraints on how it is charged

Geli’s intelligent energy storage software solutions provided the building load profiles, solar production estimates, and storage system operating profiles for the analysis. Woodlawn Associates provided an independent study to validate the economic calculations.

Having started this analysis without any particular point of view about the economics of solar + storage, Woodlawn found two things particularly interesting:

1. Solar and storage are strongly synergistic. The value of paired system is greater than the value of either one of the parts on its own.

2. In some cases, it may make sense to forgo storage incentives and/or the ITC, if the operational requirements of those incentives are such that it is not possible to optimize the demand charge management from the customer’s perspective.

Throughout this analysis, Woodlawn assumed that the host of these systems was also their owner. Many developer-financiers will want to offer these systems under service agreements as well. Their task will be to get project investors comfortable so they can reliably predict and monetize demand charge reductions.

To dive deeper, check out Woodlawn's post here!