Lenders of solar loans include traditional community banks as well as specialty lending platforms. Unlike a third-party ownership (TPO) model, a homeowner that purchases their solar system outright stands to fully reap benefits from rebates, tax credits, performance-based incentives and reduced electricity costs. Although the costs of home solar have decreased immensely over the past decade, a standard 5-10kW residential system still constitutes a capital outlay that many homeowners prefer to finance. The desire to preserve the transfer of solar benefits directly to the homeowner has resulted in a wide variety of solar loan offerings across the US.

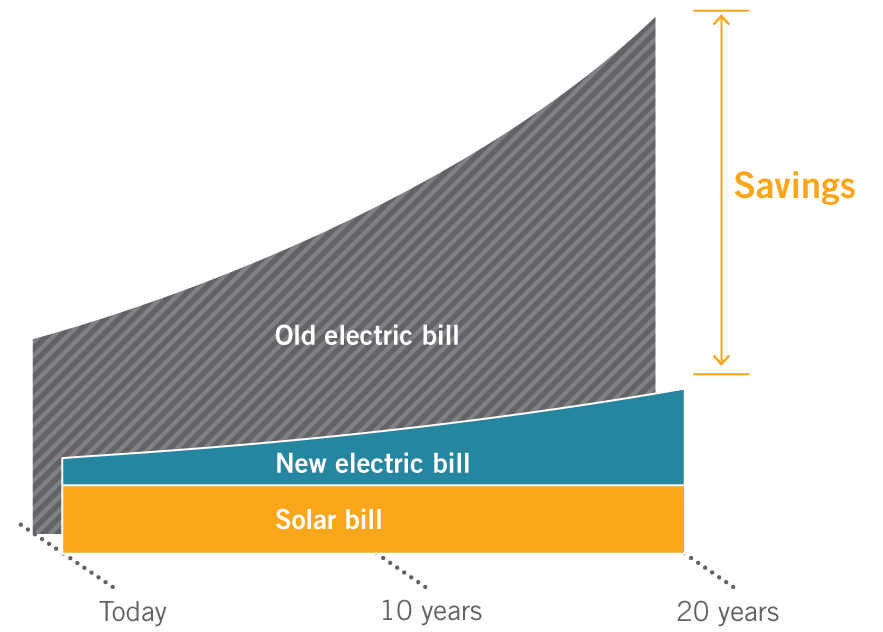

Although the solar system is financed, solar loan payments are predictable AND often less than what a homeowner is currently paying for electricity on a monthly basis. Under these conditions, savings from the solar system are realized immediately by the homeowner and are magnified if electricity prices rise over the course of the period of the loan, increasing the return on investment.

Solar loans can be generally classified into two categories: secured and unsecured. Each type of loan product offers benefits and drawbacks that a homeowner should consider carefully prior to signing. Secured solar loans you may know today as home equity loans or as a second mortgage. In this case, the lender requires the homeowner to use their home as collateral against the loan. If for some reason the homeowner cannot pay back the loan the lender will place a lien against the home, allowing them to use this asset towards repayment of the loan.

While at first this may sound like a rotten deal for the homeowner, secured loans come with several benefits. First and foremost, secured loans are less risky for banks to issue and usually offer homeowners lower interest rates. For the same reason lenders are more apt to provide loans to folks with less than perfect credit when borrowing against an asset. In many cases, interest paid on secured loans is tax deductible, an impactful benefit if a homeowner's tax liability is large enough. Lastly, many secured solar loans do not require any money down on signing or penalize the homeowner on payments made ahead of schedule.

If a homeowner is not comfortable putting up their home as collateral, or if they do not have sufficient equity in their home for a second mortgage, an unsecured loan should be considered. The tradeoff for not providing the home as collateral is often higher interest rates when compared to a secured loan. Similarly, interest paid on an unsecured loan is not tax deductible. If a homeowner defaults on this type of loan, the lender will often hire a collection agency and the homeowner's credit score will suffer. Zero money down options are also available to homeowners exploring unsecured loans. Lastly, as unsecured loans do not use the home as collateral, no appraisal is necessary, reducing the time it takes to secure the loan.

Solar installers should carefully consider whether they want to direct their customer to a traditional bank or a lending platform. Lending platforms are not a bank, rather a channel for independent contractors to access relatively low cost loan products. Furthermore, homeowners cannot get a loan directly from a lending platform and only authorized contractors (“dealers”) can offer their financing. The qualifications for becoming a dealer vary by platform, but most require at least 2-years of operation and good business standing. The key difference between a lending platform and conventional bank is the turnaround time. Because they use online tools and have paperless approval processes, lending platforms allow for almost immediate approval and funding for solar projects (for qualified homeowners).

In conclusion, there are several pros and cons of each type of loan offering to consider when looking to finance your solar system. If a homeowner has sufficient equity in their home and the time to allow for a home appraisal, a secured loan will offer lower monthly payments, more favorable terms and tax deductions on interest. If a homeowner lacks time or sufficient equity in their home to pursue a secured loan, an unsecured offering could be best, however the terms will be less favorable.

Recognizing the value in solar loans for both homeowners and local installers, the Massachusetts Clean Energy Center launched the Mass Solar Loan (MSL) program in 2015. The program seeks to seamlessly connect homeowners, installers and lenders to expedite the financing and installation of solar within the state. Using funding from utility compliance, the MSL also provides loan support for qualifying residents. More info on the Mass Solar Loan can be found here.

An updated version of this article can be found here.

Contributors: Conor Walsh, Charlie Seltzer

Comments

Great article. Well fleshed out summary of all the financing options!

Ahmed, sorry I did not see your message earlier. Please feel free to give us a call if you would ever like to discuss financing in more depth.

800.409.2257

Thanks for reading!