¿Vamos pa’ México?

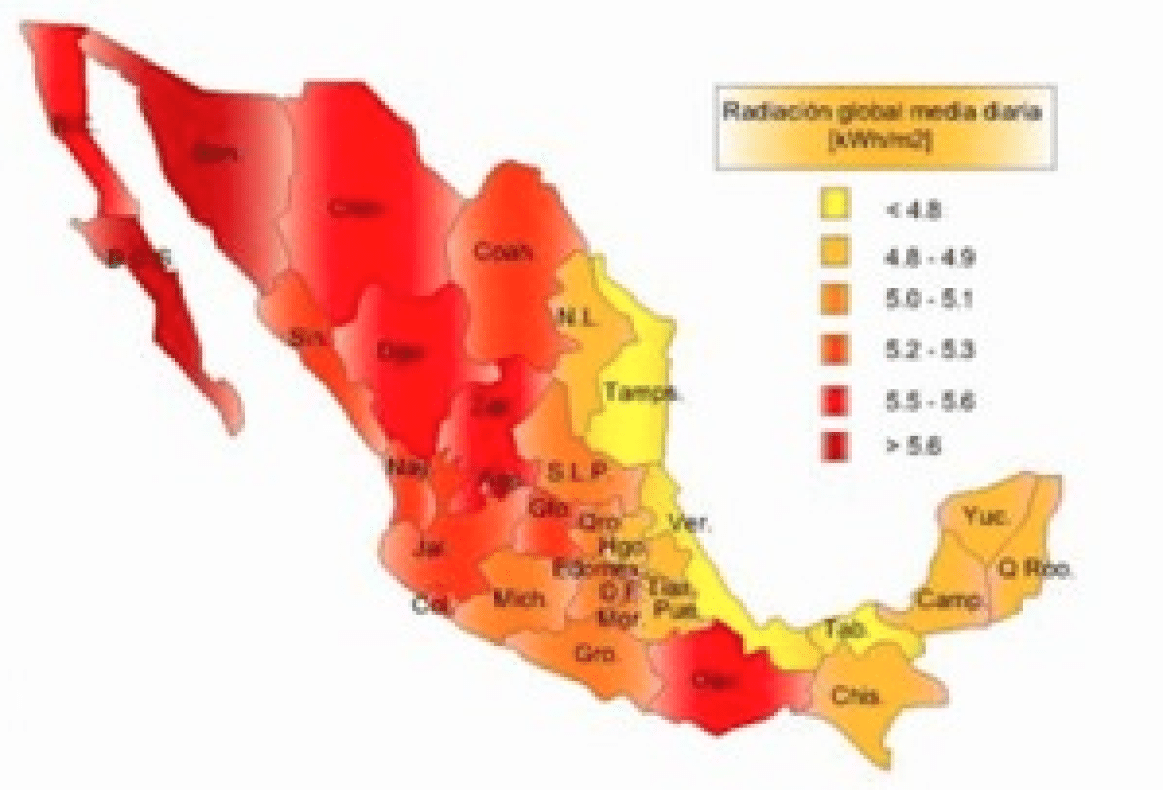

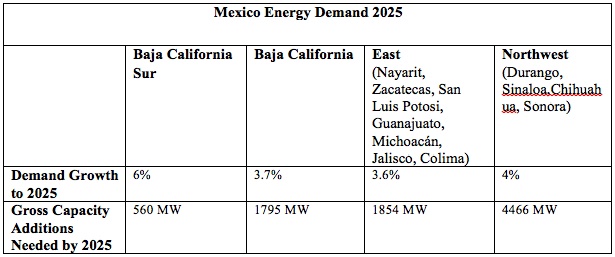

Several factors make the Mexican solar market exciting to solar professionals. More than two-thirds of the country has more than 4.5 sun hours a day and Jalisco, one of the largest states, has 5.2 hours and 20% of energy generation comes from diesel generation. Energy consumption will only increase in this country of 120 million people; forecasts have annual GDP growth at 3.5%(1) and electricity demand at 4.3% annually until 2025. Public policy is also favorable in Mexico. Under the North American Free Trade Agreement (NAFTA) solar equipment enters duty free from the United States and Canada(2). In 2007 Mexico enacted net metering and the government plans that renewables will generate 35% of the country’s energy by 2025(3).The solar market should grow to 240 MW by the end of 2014 and Bloomberg estimates clean energy investment at $2.4 Billion in 2014(4),(5). However, Mexico’s subsidized electricity rates, minimal consumer awareness, and lack of solar financing tools significantly reduce Mexico’s attractiveness.

When looking at solar projects in Mexico, it is important to understand the rate structures and the state’s role. Secretaria de Energía, Ministry of Energy, sets all laws and policies to ensure that Mexico’s energy is competitive, sufficient, and sustainable. The Mexican constitution says that the state is responsible for the control and development of the electric industry. The Comisión Federal de Electricidad (CFE) is the state-owned electric company and CFE is the only organization that distributes energy and it produces more than 90% of Mexico’s energy(6). In addition to the CFE, the Comisión Regulación Energia (CRE) supports the national electricity by granting permits, authorizing transportation and transmission, resolving energy disputes, and imposing sanctions among other responsibilities. Even though they do not have authority to set tariffs rates and end-user prices for electricity and natural gas, the CRE approves the methodologies for calculating electricity prices. The Ministry of Finance (through the Secretaría of Hacienda) sets the electricity rates based off of previous consumption, voltage, user type, and service (uninterrupted or interrupted). In Mexico there are at least 30 rates.

The CFE sells much of the energy at a loss. The first 150 kW/month of consumption has a final price of around $.10/kWh and the next consumption tier is less than $.15/kWh. The De Alto Consumo (DAC) rates come into effect around 250/kWh a month of consumption, which is about $.22/kWh. The CFE applies this rate to ALL consumption—not based on tiers—and households and businesses receive this rate on previous’ months consumption. Nearly all commercial entities, roughly 3.5 million, and .5 million households, 4% of the population, are in this sector. Solar makes economic sense for them even without tariffs. With current equipment prices and installation costs, payback periods will be from 4 to 5 years in Mexico for residential and light commercial projects. The majority of these half-million people are in Mexico’s three largest cities Mexico City, Guadalajara, and Monterrey. Another region that has high rates (more than $.20/kWh) is the La Baja de California.

Solar developers and installers note three other challenges in Mexico are a lack of consumer awareness, skilled installers, and financing tools. To address this solar-leasing companies, similar to U.S.’ SolarCity, such as Grupo Envolta and Enercity offer households and businesses solar leases. CI Banco and FIDE, Mexico’s state owned renewable energy financier, offer loans for small and medium sized businesses and individuals. The CI Loan has a 15% annual interest rate and is only available for high consumption (DAC). These products will significantly increase distributed generation in Mexico.

Mexico’s net metering system creates interesting opportunities. Compared to other countries and jurisdictions in the U.S., setting-up a meter is relatively fluid in Mexico. The turn-around for the application and inspection is around 45 days and it only requires one form. There is no push-back from the CFE, which supports non-fossil fuel generation. Net-metering covers up to 500 KW and Mexico also has virtual net-metering—allocating credits energy credits to other meters. For example, a supermarket in Mexico City could off-set its electricity by building a solar plant in La Baja de California. However, there are no current cases of virtual net metering in-place. In addition to the small producer program (projects less than 500 kW), projects that support agriculture are eligible for a 30% tax credit.

Although significant barriers exist, Mexico offers excellent opportunities in solar. Labor costs are lower than the U.S., equipment costs are high (effectively there is no local PV equipment distribution), and there is not the same competition among solar installers as there is in the U.S. The World Bank Group rates Mexico has the third best country in the region (excluding Puerto Rico) to do business. Given the success of many diverse multinational corporations and their continued investment in Mexico, Mexico is a great country for foreign commerce(7). Of course, the low electricity tariffs discourage solar investment and dimmer solar’s outlook. However, the Peña Nieto government has demonstrated a commitment to deregulation and ending monopolies and it is unfathomable that retail electricity rates do not rise. Without question, Mexico is the most attractive solar market in Latin America for the near-term.

1 However, Mexico’s GDP growth was 1.2% in 2013 and 52.3% live below the poverty line. The GDP has been revised down to 2.5%.

2 Mexico does have a 15% tariff on Chinese products and it is enforced.

3 It should be noted that the CFE projects solar to be around 1% of total generation.

4 Because of a delayed energy reform package, total installations are 150 MW.

5 Clean energy investment in Mexico in 2013 was just over $1 billion, and this figure has not separated solar.

6 Mexico is in the process of implementing a historic energy reform that will allow companies to sign contracts directly with solar companies and mandates renewable energy certificates.