Simple Payback

Among the most commonly discussed and simplest financial indicators is the payback period. Payback period is nearly always included in project proposals as it is an easy metric for most customers to understand. It is calculated by comparing cash flows derived from the system to the overall upfront system cost. At the point in time when cumulative bill savings (and RECs or other incentives where applicable) equal the upfront system cost (less rebates and tax incentives), the system has effectively paid itself off by recouping the full upfront cost. Payback period is most commonly presented in years.

While simple payback is intuitively attractive to solar sales professionals and buyers alike, this metric is limited in the scope of explanatory power. In short, the shortcomings of simple payback analysis are:

-

There is no clear definition of what constitutes a reasonable payback period.

-

The analysis fails to account for savings subsequent to the system payback point.

-

The analysis does not incorporate interest rate or discount analysis meaning savings are not comparable to other investments.

.

Net Present Value (NPV)

The following metrics rely on estimating the cash flows derived from a PV system. Although these differ by project and state. Some examples include:

-

Electric bill savings, including net metering (usually with a utility rate escalator)

-

Renewable Energy Credits

-

Changes in tax liability

-

Operations & Maintenance Costs

Net present value is built upon the foremost guiding tenant of modern human society; the time value of money. The time value of money conceptualizes the notion that money available today is more valuable than money available in the future. If we think about it, this makes sense. The money you have today can be put in a savings account to accumulate interest. For the money you receive in the future you forego this interest income. In summary, when evaluating future cash flows derived from a solar system, we must discount those cash flows to reflect the time value of money. When all future cash flows are added together we are left with the NPV of the solar project. This NPV figure can be interpreted as the total lifetime value of the PV system today. The higher the NPV figure, the more valuable the system and the investment.

The major consideration in computing or evaluating the NPV value is the discount rate used in the calculation. This rate tells us numerically how much we are discounting future cash flows. For better or worse, no constant discount rate exists for NPV calculations. The party performing the NPV calculations must assign this value. Common discount rates include the weighted average cost of capital or the rate otherwise available in the market (bond yields, savings account interest rate, or money market interest rate).

Internal Rate of Return (IRR)

Similar to NPV, the internal rate of return (IRR) seeks to discount future cash flows to gauge the strength of the solar investment. The IRR is the discount rate that sets the NPV of a project equal to zero. This rate represents the percentage growth rate that the owner earns from the PV system cash flows. The larger the IRR the faster the growth of the return on the investment.

Key to interpreting the IRR is the discount rate we discussed in regards to NPV. By comparing the NPV discount rate to the IRR we can effectively gauge the investment threshold of the project (should you invest or not), and compare multiple system proposals (assuming the NPV discount rates remain constant). For example, if a proposal assumes a 5% discount rate and the IRR of the system’s cash flows is 12% should you invest in the system? Since the IRR is greater than the discount rate we should invest in the system as our rate of return will grow faster with the solar project than a baseline investment. If the IRR of the project falls below the discount rate the investment is questionable and the system may warrant a redesign.

The true power of IRR lies in its ability to compare dissimilar projects and investments. In this way, IRR can be used to compare two different solar system proposals or a solar investment to another unrelated investment.

Comparing NPV & IRR

Used in conjunction, NPV and IRR provide a clear picture of the strength of a solar proposal in relation to other solar systems as well as other investments. As was alluded to above, NPV is an absolute measure while IRR is a relative measure. With this in mind, how would we approach the following two sample proposals? Which would you select for your solar investment?

Project A:

Discount Rate - 5%

30-Year NPV - $13,906

30-Year IRR - 11.8%

Project B:

Discount Rate - 5%

30-Year NPV - $11,200

30-Year IRR - 15.5%

Although this example is a dramatic simplification, it offers a useful exercise in assessing the relative strengths of NPV and IRR. Despite having a lower IRR, Project A is most likely the better solar investment, all else held equal. Although Project A will not deliver a return as fast as Project B, in the end, Project A will deliver nearly 25% more value to its owner over the lifetime of the system.

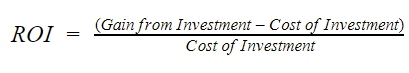

Return on Investment (ROI)

Return on investment is another common fixture on solar financial proposals. ROI measures the benefit of the investment to the investor (system owner) as a ratio of the total project cost. In other words, ROI measures the efficiency of the investment.

Does this mean the proposal with the highest ROI is the best solar system investment? Not necessarily. The most simple ROI calculations ignore the time frame associated with the returns. This means a project with a particularly attractive ROI may not deliver returns within the investors reasonable time horizon. For this reason, it may be wise to inquire as to whether the ROI calculation factors NPV into the gain portion of the equation. You may also consider using IRR to better understand the rate of return associated with a project’s ROI.

If you would like help in performing any of the analyses discussed above, contact your Greentech Renewables Account Manager to develop a proposal for your next residential, commercial, or solar + storage project.