In the world of residential solar, one of the most universally beneficial practices I know of is Direct Pay. As covered previously, Direct Pay is one of the four main strategies installers use to cash flow their purchase of equipment, and it’s at the core of what we do here at Greentech Finance Solutions. We truly believe that a broader adoption of Direct Pay will drive a stronger, more resilient solar industry. At the core, that’s why we are passionate about what we do at Greentech Renewables every day.

What is Direct Pay?

Direct pay is a three-way relationship between a Lender, an Installer, and an equipment Supplier (like Greentech).

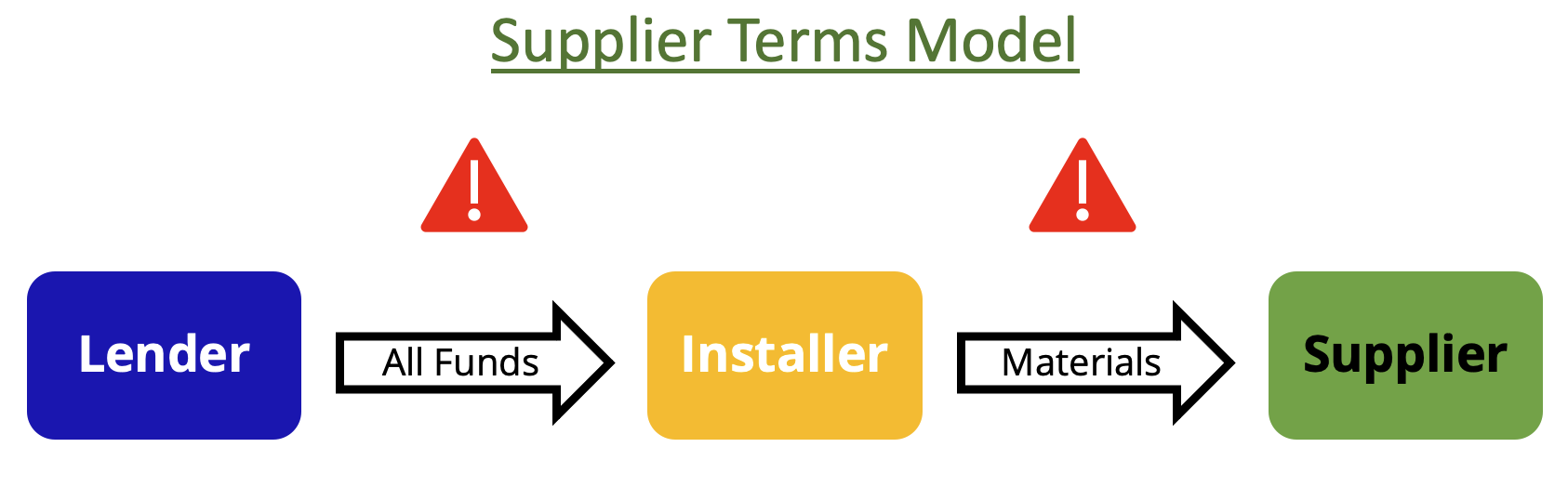

As we covered last week, the more traditional way cash flows between these three entities is the Supplier Terms Model, shown below.

- Installer procures material from Supplier on a credit line - usually on net 30 terms and governed by a credit limit

- Installer uses the materials to install the project

- Lender pays Installer full project costs

- Installer pays Supplier for materials

This model works, but is susceptible to many possible breakdowns along the way (as will be explained more below).

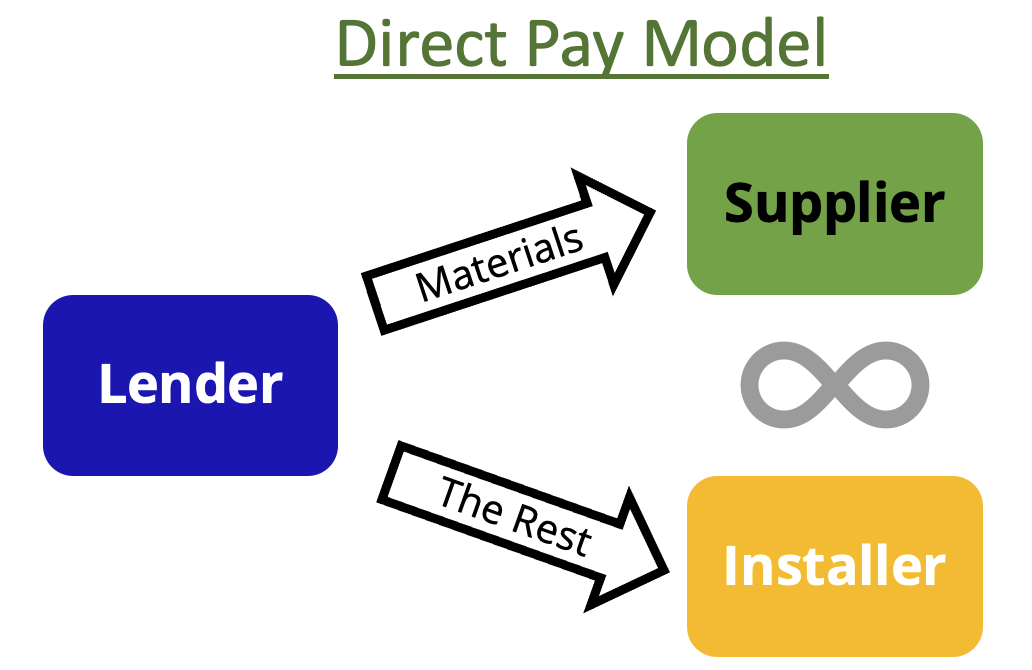

Direct Pay, by contrast, looks like this:

- Lender pays Supplier directly for materials

- Once installed, the Lender pays the Installer for the balance of project funds

Because the funds for materials need to go to the Supplier anyway, Lenders are typically happy to pay the Supplier directly as long as the Installer agrees. And because Lenders are typically lower-risk counterparties than Installers, Suppliers are able to release materials with greater certainty of timely payment. Overall, this model frees up cash flow and mitigates risk for all parties involved.

Pitfalls of the Supplier Terms Model

The Supplier Terms Model is a vital component of how materials are procured across the industry, but it has several potential pinch points that can restrict the steady flow of cash between parties, creating risk:

- Credit constraints — Fast-growing Installers are often constrained by the limit on their credit account with their Supplier. Obviously, bumping into this limit is a risk for the Supplier, but it can also slow down installations - an adverse effect for both the Installer and the Lender.

- Lender issues — In this model, the Supplier’s payments are dependent upon steady cash flow from the Lender to the Installer. If this cash flow is disrupted, the Supplier is at risk of not being paid. Recent examples of lender-related issues that ultimately delay payments to Suppliers include:

- Lender payment delays - especially with TPO projects

- Tightening payment terms — such as the removal of upfront disbursements, increased percentage of PTO holdbacks and tighter clawbacks

- Market forces — Net metering changes, interest rate increases, uncertainty around policy incentives, etc. — forces such as these can drive down sales, disrupt cash flow and delay payment to the Supplier.

- Force majeure events — For an installer with a tight credit line, a month where it dumps rain on 5 of 20 working days could slow down the cash flow from installations enough to put them outside of terms with their supplier. Likewise in the case of fires, earthquakes or other natural disasters outside of anyone’s control.

- Cash management — Appropriately managing cash is one of the toughest aspects of residential solar. When equipment is “floated” by Supplier credit, it creates an opportunity for Installers to spend cash that should instead be reserved for repaying their Supplier within terms. Cash management issues combined with unforeseen challenges (like above) creates a cash crunch.

If cash is oxygen for a business, then Installers who encounter these obstacles while using the Supplier Terms model can feel like they are breathing through a straw.

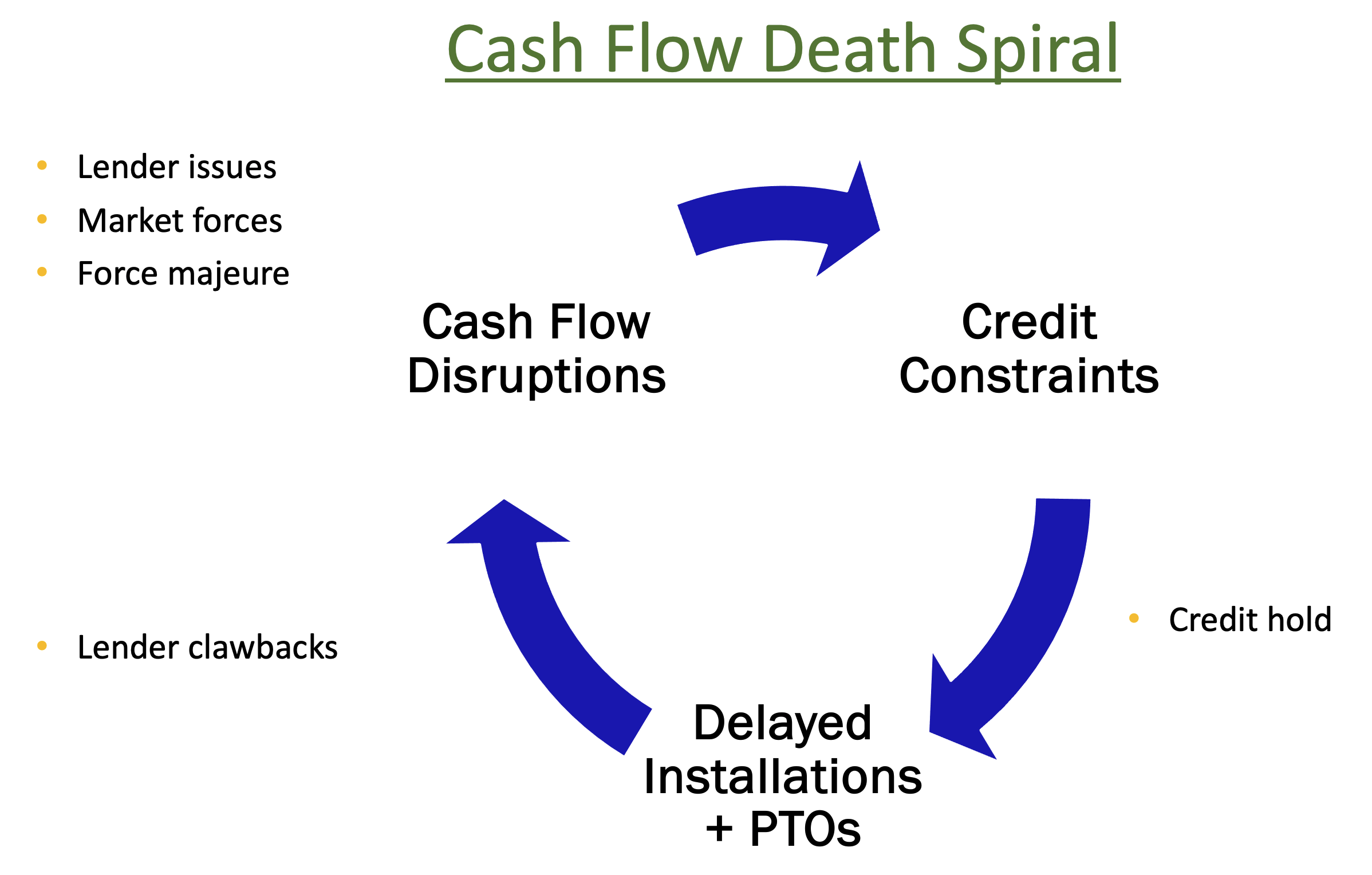

The Cash Flow Death Spiral

Unfortunately for all parties involved, many of these challenging dynamics can have compounding effects on an Installer’s cash flow when using the Supplier Terms model, tightening the straw until the breaking point. I call this the Cash Flow Death Spiral, and it works like this:

- Lender delays (or other issues like market forces or cash mismanagement) delay the Installer’s ability to pay back their Supplier.

- After attempting to work through the problem, the Supplier is forced to put the Installer’s credit line on hold until they are repaid within terms.

- Unable to access materials due to the Supplier’s credit hold, the Installer is unable to install and PTO projects promptly, causing jobs to exceed the maximum timelines allowed by their Lender.

- At some point, Lenders are forced to cancel or claw back funds from the Installer for projects that age out, further disrupting the cash flow from Lender to Installer.

- Eventually, the compounding effects of these dynamics can become overwhelming and force the Installer out of business.

Even an Installer with great sales teams, capable installation crews, and good intentions can go out of business when the Cash Flow Death Spiral kicks in. Bad things happen to good people every day. We’ve lost far too many solar companies in the past few years, and some version of this pattern has undoubtedly played a part in the demise of most.

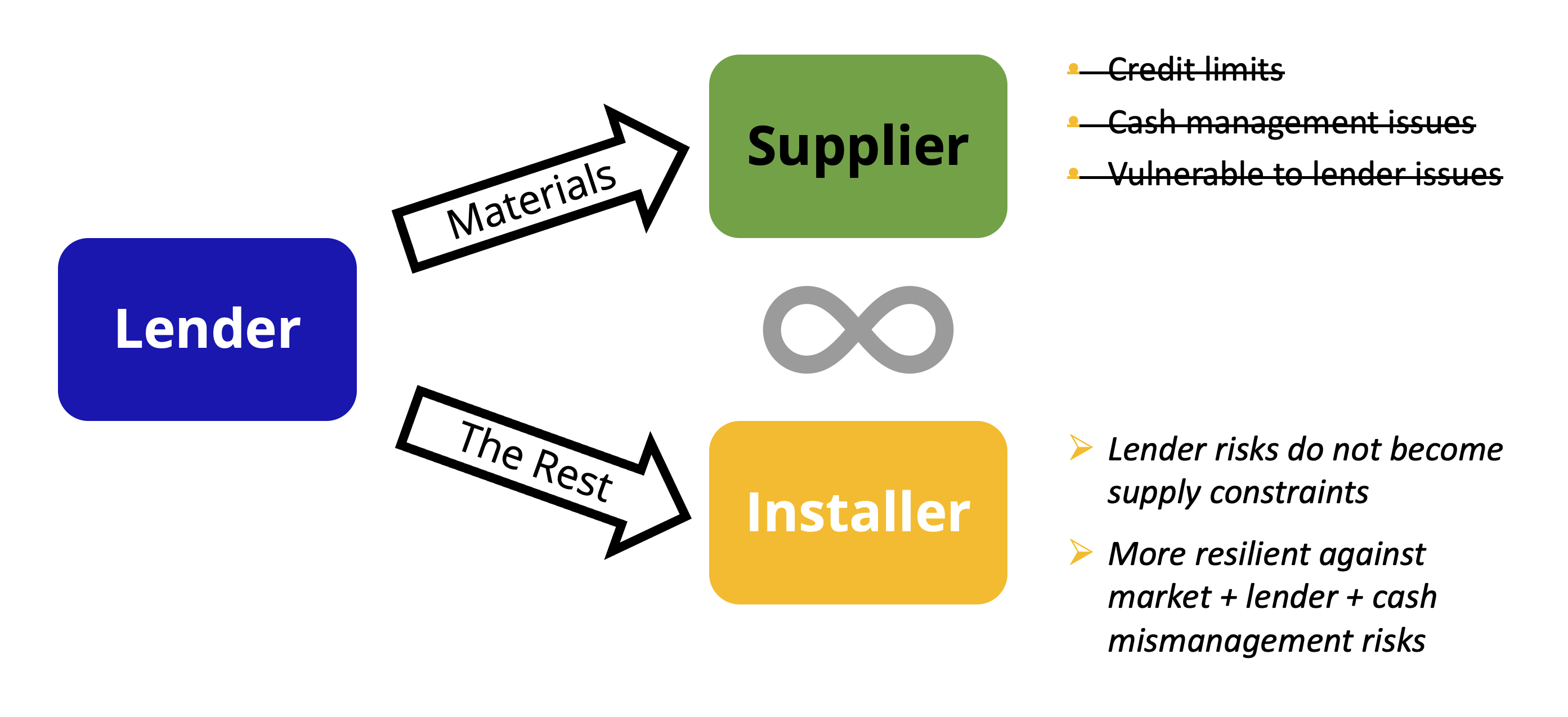

Direct Pay Is A Better Way

Direct Pay is not a magic pill to keep any Installer in business, but it’s a great start. It mitigates many of the aforementioned risks and makes it easier for Installers to navigate choppy waters without falling into the Cash Flow Death Spiral.

For starters, Direct Pay gives Installers breathing room by removing the constraint of a limited credit line. Take, for example, a growing installer who has ramped up their installation schedule to 30 jobs per week.

- Assuming each project requires $10,000 in materials and they have 120 installs/mo, they would need at least a $1.2M credit line with 30-day terms from their supplier just to keep up with their current pace (not feasible for most companies).

- However, if 25 of the 30 projects each week use Direct Pay, this fast-growing Installer is much more able to cover the remaining five with their existing lines of credit.

- They can continue to scale their business indefinitely as long as a high percentage of projects use Direct Pay.

Second, Direct Pay insulates the Supplier from many risks - specifically, cash mismanagement by the Installer and spillover effects from Lender issues or other factors that could cause the Installer to miss payments. The primary benefit to the Installer is that market and lender risks do not become supply constraints.

In short, Direct Pay ensures the Installer has consistent access to supply, even in the most difficult market conditions. They still need to sell projects, perform the work and operate ethically, but Direct Pay removes many of the factors that typically initiate the Cash Flow Death Spiral.

Why We Love Direct Pay

Like riding a bike, Direct Pay has a deep list of benefits. It de-risks all parties involved in the transaction:

- Homeowner — Installers with guaranteed access to materials get their projects installed and activated more quickly than those with credit constraints

- Installer — Ensuring steady access to materials acts as a shock absorber for unforeseen challenges that could otherwise initiate the Cash Flow Death Spiral.

- Lender — Ensures Installers have unrestricted access to the materials needed to continue installing projects in a timely manner and mitigates the risk of losses.

- Supplier — Guaranteed payment by a very trustworthy counterparty (Lender) allows more materials to be released than traditional credit lines do.

- Offtake Investor — When the installation/PTO process is significantly delayed by cash flow constraints, and especially when the installer goes out of business, homeowners are less likely to pay their bills on time. The more of these scenarios capital partners see, the more risk they price into solar financing products (this is part of the reason that rates have increased so much). Direct pay correlates with better investor outcomes, a critical priority for all parties involved.

The mission of Greentech Finance Solutions (GFS) is to promote a healthier solar industry by facilitating Direct Pay partnerships between Installers and the industry’s premier Lenders. We love Direct Pay because implementing this one simple structure takes care of all relevant parties at once, allowing Installers to do more of what they do best — selling and installing solar.

If you are interested in exploring the benefits of Direct Pay programs for your business, contact our GFS team today.