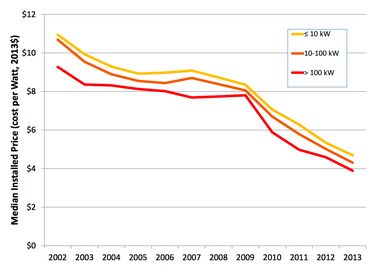

The solar market in North Carolina is by far one of the most active in both the Southeast region and the country. Although this state isn't in a region known for considerable solar development, North Carolina just recently tipped over the 1 GW installed capacity threshold. Spurred by a combination of residential installations and large utility fields, North Carolina has served as a model for the positive impacts of targeted energy policy at the state and federal level. While on its way to 1 GW of installed capacity, local investments have totaled nearly $2 billion since 2008, generated $1.8 billion in revenue and created over 4,300 in-state jobs. Throughout this period of immense growth, installers managed to decrease the installed cost from $8 per watt in 2007 to less than $4 per watt on average today.

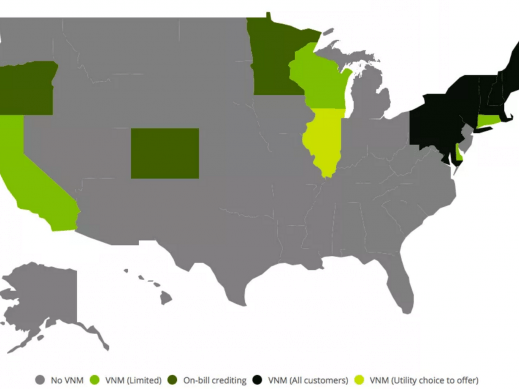

North Carolina now ranks among the top solar states in the US. However, the proportion of capacity that is constituted by residential systems remains low compared to other leading solar states like California and Massachusetts. Although 450 distinct installation companies call the state home, the prohibition of third party ownership and VNM (Virtual Net Metering)Community Solar continues to hamper the state’s large residential potential. In the absence of these programs, the state's rapidly increasing solar capacity can be attributed to the North Carolina Renewable Energy Investment Tax Credit (REITC).

Similar to the 30% federal ITC the NC REITC offers 35% return of eligible system cost up to 50% of the taxpayer’s yearly liability. Homeowners and corporations alike have benefited substantially from pairing the state and federal credits. For instance Apple has built large solar fields to offset data center energy usage. Initially established in 1999 the REITC has been renewed in five year increments culminating in a December 31st, 2015 expiration. Many solar companies in the state signed a petition urging an extension or gradual step-down, citing positives like employment and rural investment, however in the end the credit did not survive the final budget.

What does this mean for solar in North Carolina? Luckily a provision does exist that allows utility solar projects to take advantage of the REITC as long as the system is 80% complete by the end of the year. For the residential market, homeowners will still have the 30% federal tax credit to count on through the end of 2016. In many ways the REITC expiration in NC at the end of this year may foreshadow impacts of the expiration of the federal tax credit next year. While some contraction is to be expected in the short-term, NC stands to remain a leader in US solar. For one, the state is already home to a contingency of efficient installers setup to sell directly to homeowners. Secondly, although substantial, a 35% credit loss will not set the state back too far in terms of total installed cost compared to where it was 5 years ago.